Providing a home loan without an appraisal is like going on an African safari without a guide. You may be safe for a while but something bad is bound to happen – like getting charged by a rhino or losing part of your home investment.

With that dire prospect in mind, a mortgage lender will not approve a buyer’s loan without detailed and reliable support of the home’s current market value.

Hustling homebuyers and savvy sellers should understand how the Bakersfield home appraisal process works, what appraisers look for, and how a home’s fair market value is derived.

Let’s tour the Serengeti of appraisal blog posts.

What Is A Home Appraisal?

An appraisal is a professional analysis of a home’s value performed by a licensed appraiser. Appraisals are almost always required in home purchases and refinancing.

For a home purchase, an appraisal is done to determine whether the contract price equates to fair market value, given the home’s location, condition, and features.

For a refinance, an appraisal ensures that the new loan maintains a specified amount of equity (loan-to-value ratio).

A house serves as collateral for a mortgage, so a lender wants to ensure that

that sufficient equity exists to recoup its investment in the event of default and subsequent foreclosure.

Appraisal Valuation Basics

An appraiser will render an opinion of a home’s fair market value under a particular valuation approach, which is almost always the sales comparison approach since it most reflects current market value.

To generate an appraisal, an appraiser will try to find multiple comparable home sales or “comps” that are similar to the subject property. Since any two properties are rarely the same, an appraiser will account for differences between the subject property and comps.

The sales price of each comp is then adjusted for location, condition, square footage, lot size, age, amenities, and anything else affecting value. The appraiser’s initial task is to find comps that require minimal adjustments, and are therefore the best indicators of value.

The appraiser will then derive a market value by averaging the adjusted values of all comps. Some comps may be given more weight depending on the degree of similarity.

An appraiser will gather sales data from public records, the multiple listing service (MLS), and other data services. The local MLS is the most reliable source of real estate sales data since it contains comprehensive information about all transactions on the open market.

Check out this excerpt of a Bakersfield appraisal, which shows various value adjustments.

Reconciling Adjusted Values

After adjusting all comps for differences from the subject property, an appraiser will reconcile those adjusted sale prices to calculate a final opinion of value. Comps with the least amount of adjustments are usually weighted more heavily. Each adjusted sale price is multiplied by its relative weight and totaled. For example:

- Comp #1: Adjusted sale price is $443,500 X 40% weight = $177,400

- Comp #2: Adjusted sale price is $432,500 X 30% weight = $129,750

- Comp #3: Adjusted sale price is $459,500 X 30% weight = $137,850

Add the three totals to derive the Adjusted Home Value = $445,000

To derive an accurate home value, making detailed adjustments is an integral part of an appraiser’s job, which is reflected in the Uniform Residential Appraisal Report (URAR).

What Does an Appraisal Include?

A qualified appraiser will include the following information:

Subject and Comps Characteristics

An appraisal will describe the comps and the home being valued, which includes:

- Address

- Proximity to Subject

- Sale Price

- Sale Date

- Data Source

- Seller Concessions

- View Type

- Design

- Construction Quality

- Living Area (Square Footage)

- Bedrooms

- Bathrooms

- Year Built

- Site or Lot Size

- Basement

- Functional Utility

- Heating/Cooling

- Garage Type

- Pool (Y/N)

- Porch/Patio/Deck

- Upgrades or Misc

Location³

As you may have seen, location is so important that it’s usually mentioned three times.

An appraisal includes the addresses of each comparable sale and their distances from the subject property. Whenever possible, comps should be located within the same neighborhood or subdivision. In areas with sparse comps, an appraiser must use whatever comps are available and make adjustments.

General location factors include whether the home is adjacent to a busy road, sits in a cul-de-sac, sits on a corner lot, or two-story neighbors can see into your backyard.

The appraiser may also note the home’s proximity to services like schools, hospitals, fire stations, and police stations.

Sale Status

Comparable home sales are on three different stages of a transaction:

- Sold – The most relevant comps are homes that have recently closed escrow.

- Pending – Homes that are in escrow but have not closed. They’re the next best thing to being sold, which helps support the validity of sold comps.

- Active – Homes that are listed for sale. These may help support sold and pending sales, but are least reliable since listing prices can change at any time.

Sale Date

The best comps are the most recent sales. If recent comps are scarce, an appraiser will go further back in time and value adjustments may be made depending on whether the market is increasing or decreasing. Thus a comp that’s 9 months old might require an upward adjustment if the market is rising.

Living Area

An appraiser will include the living area (square footage) for the subject property and the comparable sales. The size of unfinished basements, garages, and enclosed patios are not considered living areas so are usually accounted for separately. Size differences are typically adjusted at $50-$100/square foot, based on building quality and local construction costs.

Bedrooms and Bathrooms

The subject property and the comps should have the same number of bedrooms and bathrooms, or else adjustments should be made.

Two homes with the same square footage might have 3 bedrooms and 4 bedrooms respectively. Although their sizes are the same, an appraiser might make a value adjustment for the extra bedroom even though the bedrooms are likely smaller.

It’s important to avoid adjusting for living area square footage as well as adjusting for extra bedrooms or bathrooms. Adjusting twice for the same space may not be warranted.

Age of Home

Houses don’t always age like fine wine. Generally, older homes are valued less than newer homes in the same neighborhood. Thus the ages of the subject property and the comps should be as close as possible.

Generally, small differences of a few years may not warrant adjustments while large age differences typically would. Keep in mind that older homes may also have dated interiors or other issues, so it’s important not to double-count what may require only one adjustment.

Lot Size

For homes in the same neighborhood, adjusting for large differences in lot size is important. A 7,000 square foot lot should be valued less than a 10,000 square foot lot, which can mean having a larger pool, RV parking, more decking, etc.

Appraisers follow adjustment guidelines depending on the area. Sometimes the adjustments are inadequate but they are difficult to refute when an appraisal comes in too low.

RV Parking

In Bakersfield, RV parking space commands a premium. Extra parking on the side of a home has a wide variety of uses including vehicle access to the backyard shop.

A value adjustment is typically warranted if lot sizes are similar but only one home has RV parking. A $5,000 adjustment or more might be in line.

Note that an adjustment for both RV parking and a larger lot size would be double-counting the difference.

Garage Space

In Bakersfield, there are scads of self-storage units for a reason – people have too much stuff. Whether it’s for a car or stuff and junk, an extra garage space can command a premium of $5,000-$10,000.

Pools

Notoriously, homeowners do not usually recoup the cost of installing a pool.

Nevertheless, the hot summers of Bakersfield make a pool an object of desire. Value adjustments range from $20,000 to $50,000, or more, depending on the pool’s size.

Solar Equipment

In Bakersfield, solar systems are a big business. Many homes have solar systems to curtail ever-increasing electric bills. Some systems are under lease agreements while others are owned. Only owned systems warrant value adjustments, typically from $10,000 to $20,000.

Condition

An appraiser will inspect the general interior and exterior condition of the home, noting any deferred maintenance, physical deficiencies, safety hazards, toxic substances, or other adverse conditions.

The appraisal will describe the type and condition of construction, flooring, counter finishes, paint, functional utility, and amenities like an outdoor BBQ.

Any lender-required repairs will be noted in the appraisal, which must be completed and verified before closing. For example in Bakersfield, the water heater must be double strapped to a wall, which will be confirmed.

An appraiser’s inspection is never meant to be a substitute for a professional home inspection, which is much more comprehensive. An appraiser will not be crawling around under the house or in the attic.

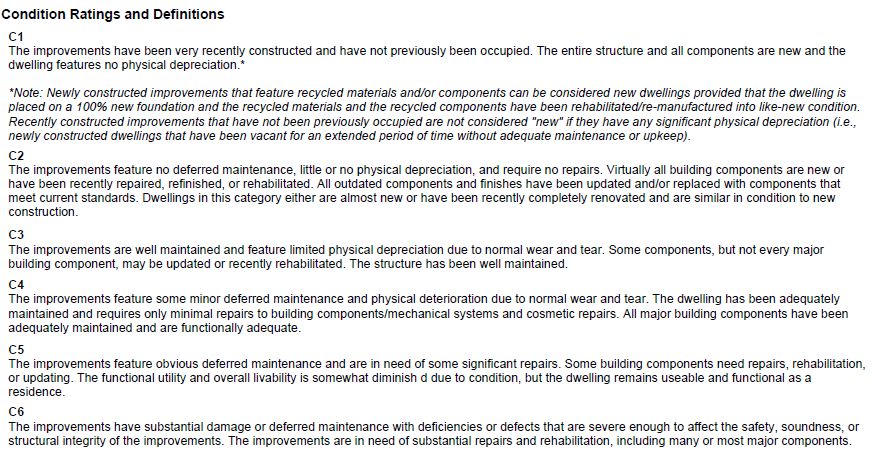

The overall condition of a home is rated between C1 and C6, with C1 being the best condition (new construction) and C6 being the worst (substantial repairs and rehabilitation needed). See below for the Condition Ratings and Definitions used in a standard appraisal.

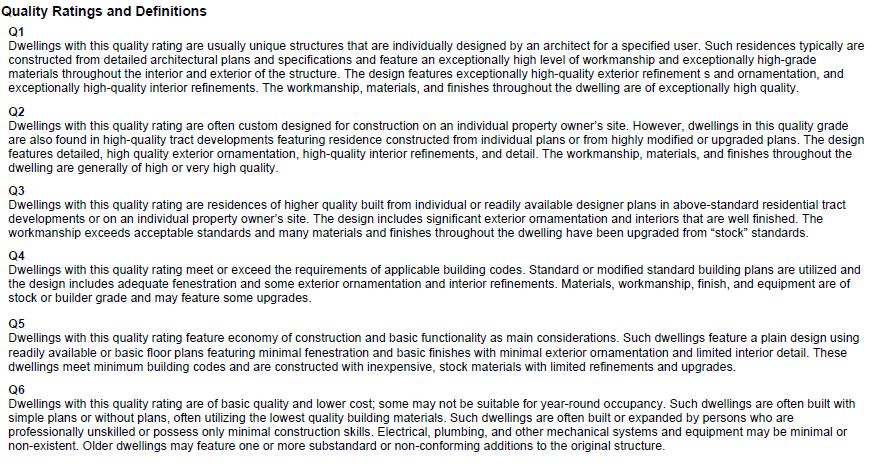

Quality

Value adjustments can also be made for the construction quality of the subject property and comparable sales. Similar to condition, the quality of a home is rated between Q1 and Q6, with Q1 being the highest quality (luxury homes with exceptional workmanship) and Q6 being the worst (low cost and minimal quality). See below for the Quality Ratings and Definitions used in a standard appraisal.

Upgrades

Upgrades or value-added improvements include renovated kitchens and bathrooms, or the addition of outdoor kitchens, shops, stables, treehouses, etc.

See a separate blog post for upgrades that may not add value.

Market Conditions

Market conditions form the sea that lifts or drops all boats, or home values.

In a declining market, comps that are four or five months old could be substantially above market value, which would inflate the appraised value. For maximum accuracy, comparable sales should have sold as close as possible to the valuation date.

In a rising market, there are usually abundant comps from which to choose. However, declining markets usually see less sales volume and fewer comps, so proper adjustments must be made for outdated comps. Flat real estate markets make appraisals easier.

Here’s a sample of the market conditions section of a standard appraisal.

Seller Concessions

An appraiser will make downward value adjustments for any seller concessions, like any buyer’s closing costs paid by the seller. The adjustment will equal the concession amount.

Bakersfield appraisers, like Bakersfield Realtors®, have access to this information from the Bakersfield MLS.

A seller concession may cover the cost of repairs to which the seller has agreed but does not want to make. The seller will simply credit the agreed amount to the buyer to pay closing costs.

View

In Bakersfield, there are a few areas where homes have views, like the Tuscany development in the Northeast or along the Kern River. There are also man-made lakes around which some homes have a backyard view. There are also many areas in Kern County where homes have views, particularly in the mountain areas like Tehachapi and Lake Isabella.

A nice view would certainly warrant a value adjustment.

Your Stuff Doesn’t Matter

An appraiser does not consider personal property when appraising a home. Anything that’s not attached to the property is not considered real property. That awesome sectional couch, pool table, or pinball machine are not pertinent to your home’s value.

Note that sometimes a buyer will purchase some of the seller’s personal property (furniture, sheds, etc.) along with the home. These items are purchased outside of escrow and not considered part of the home sale.

A Bakersfield Realtor’s Role

As a homebuyer obtaining a mortgage, your Bakersfield Realtor will discuss whether you should include an appraisal contingency. Unless you’re operating in a hot seller’s market, an appraisal contingency should be included in a purchase agreement, which enables you to cancel the transaction if the appraisal comes in lower than the contractual purchase price.

In a seller’s market, it’s common for a buyer to guarantee the purchase price regardless of the appraised value. Under an appraisal guarantee, the buyer agrees to cover the gap between the purchase price and the appraised value. The guarantee can be limited to a specific amount, say $10,000, or can be open-ended with no limit.

For example, if the agreed purchase price is $400,000 but the appraisal comes in at $380,000, an appraisal gap guarantee with no limit would mean the buyer pays an additional $20,000 in cash.

Cash purchases do not require appraisals but it’s still a good idea to get a professional opinion of value.

If the appraisal comes in low without a gap guarantee, your Realtor will help you negotiate a way to move forward. Most sellers are willing to accept the appraised value, since they will be facing the same outcome with another buyer. However, sometimes the buyer and seller must meet somewhere in the middle to save the deal.

Consult with your Realtor about the best offer strategy depending on the house, the seller, and market conditions.

Other Home Appraisal Types

Depending on your mortgage lender, your credit score, and the house, your lender may arrange a non-traditional appraisal. Technology has made it easier to determine a home’s value without an inspection, so your lender may opt for a more convenient and efficient appraisal.

Drive-By Appraisal

A lender may order a drive-by appraisal, or summary appraisal, where the appraiser only examines the home’s exterior. Without entering the home, the appraiser must rely on public information and photos to help determine the home’s value.

Desktop Appraisal

Here the appraiser doesn’t have to leave the computer. The appraiser will rely solely on public records, photos, floor plans, and comparable sales to derive market value. These appraisals are typically faster and cheaper than a traditional appraisal.

What’s The Cost and Timing of a Home Appraisal?

In Bakersfield, a home appraisal costs between $400 and $1,000, depending on the size and location of the home. Large homes, remote locations, and rush orders will cost on the higher end.

The buyer almost always pays for the appraisal, which is required by the lender.

From start to finish, a home appraisal can take between a few days and a few weeks. The same criteria determining the cost of an appraisal also determines the time for completion, but market conditions can also affect timing. A hot market can mean longer wait times.

Appraisal Steps

- The lender requests the appraisal, typically through an appraisal management company (AMC) to limit any influence by the lender on the appraiser.

- The appraiser may or may not accept the assignment. Difficult appraisals are sometimes turned down by lazy appraisers.

- If accepted, the appraiser will research the subject property through public records.

- The appraiser inspects the property, notes condition, and takes photos.

- The appraiser chooses comparable sales that are most similar to the subject and have sold most recently.

- The appraiser makes value adjustments to the comps as explained in detail above.

- The appraiser prepares the Uniform Residential Appraisal Report (URAR) and submits it to the AMC.

- The AMC sends the appraisal to the lender, who forwards it to the buyer and Realtor.

Home Appraisal Tips For Buyers

A home appraisal can be a stumbling block if not handled properly. As a homebuyer, here are a few tips.

Think It Through

In normal market conditions, purchase offers are fairly straightforward and appraisal guarantees are rarely even discussed. You make an offer you feel comfortable with. If the offer is accepted, the appraisal can be dealt with when it’s done.

You should not make an offer that makes you squirm, which you might consider in a hot real estate market. If you agree to cover an appraisal gap, make sure you’re comfortable with your cash position after closing and that you’re paying above market value for your home. It might be worth the cost if it’s your forever home.

No Worries, Mate

As in life, don’t worry about things you can’t control. At certain times, a little prayer and meditation is all you can do. An appraisal is meant to protect your lender and you from overpaying for a house. A low appraisal just means a little negotiation or there’s a better house out there for you.

You Have Options

A low appraisal isn’t a dead end. Typically, the first response is to appeal the value. Your Bakersfield Realtor can help analyze the comps and point out any mistakes, or find better comps. This step is more likely to help satisfy the seller than change the appraiser’s opinion of value. Most values are not revised, but you never know.

If the appraised value is not changed, your options are to either cancel the purchase, contribute more cash toward the price, or agree only to pay the appraised value.

Home Appraisal Tips For Sellers

Once a home is under contract, the best thing a seller can do to maximize the appraised value is to make the house shine. Here are a few tips to help the cause.

Clean Sweep

The goal is to make your home look clean and spacious, both inside and out. Keep in mind that photos will be taken of every room, which are then reviewed by an underwriter in some random office.

The heavy lifting was likely already completed when you listed your home for sale, so now it’s about keeping things spiffy. Take care of the basics:

Interior

- Clean everything in sight including flooring, counters, windows, and bathrooms.

- Empty all trash containers.

- Keep pets out of the way.

- Replace outdated or broken fixtures and hardware.

- Touch up paint where it’s needed.

- Repair obvious things like broken blinds or torn curtains.

- If you have more money than time, consider hiring a professional cleaner.

Exterior

- Mow the lawn and trim hedges.

- Remove debris and clutter from front and back yards.

- Add some color with flowers.

- Touch up paint where it’s needed.

- Repair fencing and gutters.

- Replace leaky or ancient faucets.

- Replace the sad mailbox or address numbers.

- Maybe take down the Christmas lights during summer months.

Remove Clutter

Become a minimalist for a day. To make your home feel more spacious and organized, put away anything you can live without for a few hours. Even the air-fryer can be stashed in the pantry for a while.

Appraisers will not evaluate a home based on the amount of clutter, but conveying a good overall impression can help. Most appraisers are human so they will look more favorably on well kept homes.

Read our Complete Home Seller Checklist to do it right!

List Upgrades

Certain upgrades can increase your home’s value, so it’s fine to point them out. Not all upgrades will increase a home’s value so it’s best to provide a list and let the appraiser decide. You may love your high-end dishwasher and home theater, but they won’t likely add any value.

Get Repair Estimates

As a seller, sometimes you don’t have enough time or money to complete a repair that will negatively impact the appraised value. It’s much better to provide the lowest possible cost estimate rather than rely on an appraiser’s estimate. You would prefer the appraiser deduct $5,000 from the value rather than the $15,000 quoted by the construction cost guidebook.

Being There

While it might help for a seller to be present when the appraiser performs the inspection, it’s also nice to stay out of the way. Providing information about upgrades and repairs, and answering questions, should be the full extent of a seller’s involvement.

Do not discuss where you think the appraised value should be. The appraiser’s job is to render an impartial opinion of value, so pressing for a certain value will only make things uncomfortable.

Further, providing comparable sales is mostly a futile effort since an appraiser has access to more data than most homeowners.

The Final Value

When a Bakersfield appraiser delivers the good news of a full appraised value, it’s like sighting a majestic elephant or giraffe on a safari. Well, maybe it’s not that dramatic but it’s a nice feeling. As a buyer, you know that you’re not overpaying for your home. As a seller, you don’t have to worry about dropping your price.

Yes, sometimes the value comes in low, but that can usually be handled by your Realtor. Don’t worry about things you cannot control, grasshopper.

Contact Property Wonk to buy or sell a home in Bakersfield. Connect with a top Bakersfield Realtor or just get some friendly, professional advice.