In California, a residential home seller is required to disclose details about the property being sold. Seller disclosures are designed to bring transparency to the real estate transaction and protect both the buyer and seller.

In the disclosures, a seller provides written information about known issues that could materially affect the property’s value, such as a leaky roof or faulty HVAC unit, as well as details like homeowners association fees, easements, and restrictions.

Proper seller disclosures provide the buyer with a comprehensive history of the property, which helps to avoid nasty surprises that may provoke a lawsuit.

Standard purchase offers set a deadline for the seller to deliver disclosures and the number of days the buyer has to review them. The contingencies in the purchase agreement allow the buyer to revise the offer or cancel the deal based on the disclosures.

What must sellers disclose about a property?

Sellers should disclose anything and everything they know about. The best approach is to over-disclose!

Every property has defects to some degree. Sellers often live with defects that seem unimportant but may be important to a buyer. Even if issues have been resolved, a seller should disclose any previously completed repairs or other potential impediments to property value. Of course, a seller can’t disclose something of which they are unaware, but that’s what inspections are for.

In California, disclosures are detailed on the Real Estate Transfer Disclosure Statement (TDS) and the Seller’s Property Questionnaire (SPQ). However, a seller must still disclose any known material defects even if items are not covered on those forms.

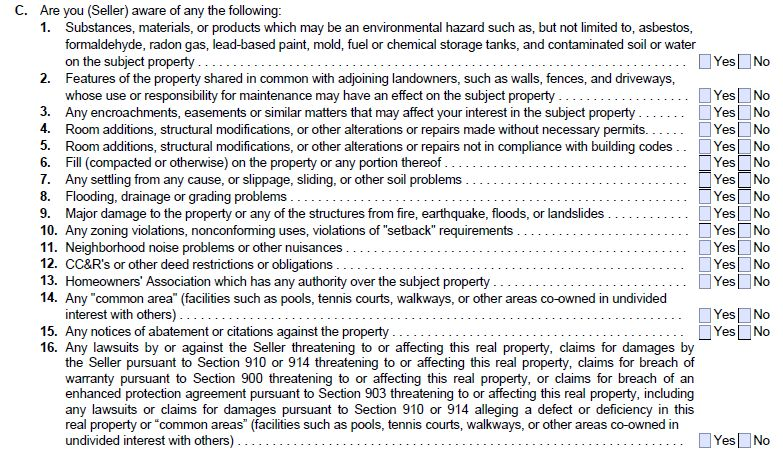

Below is a section of disclosures that must be completed by the home seller.

What is the Transfer Disclosure Statement (TDS)?

Required by state law, the Transfer Disclosure Statement is a form the seller must complete and deliver to the buyer as soon as practicable before the transfer of title. Under no circumstances should a real estate agent fill out this form for a seller.

The seller must list the various features of the property and disclose whether they are in operating condition. Sellers must also state whether they are aware of a variety of common issues, which are outlined in the abbreviated list below.

1. Substances, materials, or products which may be an environmental hazard.

2. Features of the property shared in common with adjoining landowners.

3. Any encroachments, easements or similar matters that may affect your interest in the subject property.

4. Room additions, structural modifications, or other alterations or repairs made without necessary permits.

5. Room additions, structural modifications, or other alterations or repairs not in compliance with building codes.

6. Fill (compacted or otherwise) on the property or any portion thereof.

7. Any settling from any cause, or slippage, sliding, or other soil problems.

8. Flooding, drainage or grading problems.

9. Major damage to the property or any of the structures from fire, earthquake, floods, or landslides.

10. Any zoning violations, nonconforming uses, violations of “setback” requirements.

11. Neighborhood noise problems or other nuisances.

12. CC&R’s or other deed restrictions or obligations.

13. Homeowners’ Association which has any authority over the subject property.

14. Any “common area” (facilities such as pools, tennis courts, walkways, or other areas co-owned in undivided interest with others).

15. Any notices of abatement or citations against the property.

16. Any lawsuits by or against the Seller threatening to or affecting this real property

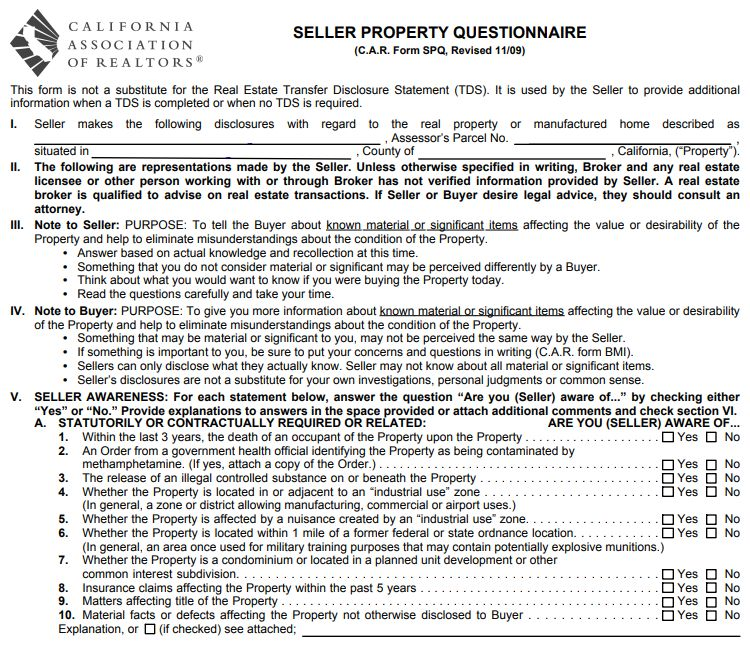

What is the Seller Property Questionnaire (SPQ)?

The Seller Property Questionnaire is required by contract and not required by law. In residential purchase agreements for homes, the SPQ is required only when the TDS is also required. If a seller did not want to provide the SPQ, they could modify the terms of the purchase agreement, typically in a counteroffer.

The SPQ is designed to trigger the seller’s memory about the property and prompt the seller to disclose specific material facts. The seller must disclose all known material facts, even if those facts relate to things that occurred in the past, even prior to the seller’s ownership of the property. The seller should answer the questions based on the seller’s actual knowledge, regardless of how much time has passed. Additionally, the last question of the SPQ asks the seller to turn over copies of reports, inspections, disclosures, warranties, maintenance recommendations, estimates, studies, surveys “or other documents” pertaining to the condition of the property.

Sample questions from the SPQ (asking if the seller is aware of the following):

1. Within the last 3 years, the death of an occupant of the Property upon the Property.

2. An Order from a government health official identifying the Property as being contaminated by methamphetamine.

3. The release of an illegal controlled substance on or beneath the Property.

4. Whether the Property is located in or adjacent to an “industrial use” zone.

5. Whether the Property is affected by a nuisance created by an “industrial use” zone.

6. Whether the Property is located within 1 mile of a former federal or state ordnance location.

7. Whether the Property is a condominium or located in a planned unit development or other common interest subdivision.

8. Insurance claims affecting the Property within the past 5 years.

9. Matters affecting title of the Property.

10. Material facts or defects affecting the Property not otherwise disclosed to Buyer.

Other sections of the SPQ include, but are not limited to:

- Repairs & Alterations

- Structural, Systems and Appliances

- Disaster, Relief, Insurance or Civil Settlement

- Water-Related and Mold Issues

- Pets, Animals and Pests

- Boundaries, Access and Property Use By Others

- Landscaping, Pool and Spa

- Common Interest Condominiums and Developments

- Title, Ownership and Legal Claims

- Neighborhood (Noise, nuisance or other problems, et al)

- Governmental (Ongoing or contemplated eminent domain, condemnation, annexation, et al)

- Other (Reports, inspections, disclosures, warranties, et al)

Below is a section of the SPQ.

Natural Hazard Disclosure (NHD) Statement

Sellers and agents of any real property must disclose to a prospective buyer if the property is in one of six types of natural hazard zones. Those zones on the Natural Hazard Disclosure Statement (NHD) are:

1. A flood hazard zone as designated by the Federal Emergency Management Agency.

2. An area of potential flooding after a dam failure.

3. A very high fire hazard severity zone.

4. A wildland fire area (also known as “state fire responsibility area” or “SRA”).

5. An earthquake fault zone.

6. A seismic hazard zone.

The obligation to disclose a property’s location on the NHD Statement only applies to properties improved with one-to-four residential units where no exemption applies. The requirement to disclose the fact that a property is in one of these six natural hazard zones applies to all sales of any kind of real property, regardless of whether the NHD Statement must be provided.

Federal Seller’s Disclosure Requirement

The U.S. Environmental Protection Agency provides a seller disclosure form for lead-based paint on its website. Although lead-based paint was banned for residential use in 1978, it’s still present in many housing units in California. Lead-based paint can peel, chip, and deteriorate into contaminated dust, thus becoming a hazard. Exposure can put young children at risk for lead poisoning, which can cause permanent neurological damage.

Sellers of homes built before 1978 must also provide buyers with an EPA pamphlet, “Protect Your Family From Lead In Your Home,” give buyers 10 days to conduct a paint inspection or risk assessment for lead-based paint, and include a “lead warning statement” in the contract.

What’s a Realtor’s obligation regarding disclosures?

A Realtor has a responsibility to conduct a careful visual inspection of the property and disclose the results of that inspection in the Agent Visual Inspection Disclosure (AVID). However, a Realtor is not obligated to inspect inaccessible or offsite areas, search public records, or inspect the common areas of a condominium complex or planned development.

A real estate agent must also conduct a visual inspection of the property and disclose any material facts the agent knows about. Since defects are often difficult to discover, and since a Realtor often relies on the statements of the owner of the property, the Realtor does not guarantee the condition of the property.

Does an “AS IS” sale change the disclosure requirements?

An “AS IS” sale does not exempt a seller from disclosing material information about the property. The seller must still disclose all material facts affecting the desirability or value of the property. The term “AS IS” simply means that the seller wants to avoid paying for any repairs to the property.

On a related matter, the seller is not obligated to make repairs to the property unless they are legally required to do so. The seller only agrees to make repairs through the negotiation that becomes part of the purchase contract.

What are the buyer’s responsibilities in the transaction?

A buyer should never rely solely on disclosures provided by the seller or rely on a Realtor to verify any statements by the seller, but instead, should take an active role in the transaction. Many times, a seller is completely unaware of a flaw or issue. Moreover, a Realtor’s visual inspection may not reveal material issues or smaller issues of importance to the buyer.

All properties have flaws and issues that are not immediately obvious but could affect their value or desirability. All buyers should obtain independent inspections by qualified professionals because problems are frequently hard to find and identify.

A buyer should be extremely careful, inspect the property, and obtain any important records. Because neither the seller nor real estate agents are always aware of a buyer’s special demands, the buyer must request information in areas of particular interest or importance.

How is a buyer protected from defects discovered after the close of escrow?

Homeowner’s insurance and home warranties cover many unforeseen problems. Although the sellers and Realtors make certain disclosures, they do not warrant the property to be free from defects or agree to correct defects that are discovered or occur after the close of escrow. Some responsibility falls to the buyer, who has a right to thoroughly investigate the condition of the property and negotiate solutions to any problems before moving forward with the transaction.

What vendors should be chosen to investigate the property?

An experienced Realtor® should be able to recommend any service providers needed to investigate both the physical and non-physical aspects of the property. However, the buyer and seller are free to select providers other than those referred by real estate agents, and agents do not guarantee the service quality of any providers.

The person hiring the provider ultimately makes the selection. Typically the seller, through the Realtor, will choose the escrow and title company, which are often the same in California. The buyer typically chooses the inspectors necessary to complete the physical inspection of the property.

Naturally, service providers should be selected based on their qualifications, the scope and price of their service, and the satisfaction of previous clients. Online information and reviews are easy to check. Additionally, most vendors are members of professional trade associations, which serves as an additional reference. An inspector should have a valid license, carry liability insurance, and provide written reports.

Operating in Good Faith

The best way to avoid any problems involving disclosures is for sellers, buyers, and Realtors to deal honestly with each other. Transparency is a result when all parties are aware of their respective roles in the transaction. Throughout any real estate transaction, Realtors play a pivotal role in handling various tasks and personnel. They rely on experts who are better qualified to respond to certain queries, carry out specific activities, or manage specific facets of the transaction.

Conclusion

To ensure successful real estate transactions, all parties must work together in good faith. This includes disclosing any material issues that could affect the value or desirability of the property and engaging qualified professionals to conduct inspections and investigations. Ultimately, it is up to each party to conduct thorough due diligence to avoid any potential complications or problems.

Contact Us to speak with a top Bakersfield Realtor about disclosures or anything else real estate related.