A home appraisal is an estimate of a home’s fair market value, typically performed by a licensed real estate appraiser. The purpose of a home appraisal is to provide both the buyer and seller with a solid estimate of what the house should sell for in the current real estate market.

The majority of appraisals are ordered by banks or lending institutions to assess the value of a property before issuing a loan. However, there are other instances where appraisals may be necessary, such as during a divorce settlement, legal matters, or when filing a property tax appeal.

What do appraisers look for when appraising a home?

Location

It may be obvious, but location tops the list of home value factors. A professional appraiser will assess the home’s proximity to desirable schools, hospitals, fire stations, police stations, and other services or nuisances. Also noted is whether the home is located on a busy street or a corner lot. Appraisers will also consider the property mix in the neighborhood, whether they are primarily single-family homes, apartment buildings, or commercial properties.

Condition

An appraiser will note various details in the home and physical attributes that may impact functionality or obsolescence, including any safety hazards. Maintenance-related issues will be noted such as leaky faucets, peeling paint, etc. While cleanliness isn’t necessarily considered, signs of neglect are noted including foundation issues, broken windows, damaged floors, broken appliances, missing doors, ripped carpeting, etc.

Exterior

A home appraiser will scrutinize the exterior of the home to ensure it’s structurally sound. They will look for any signs of problems like water damage, a cracked or leaning chimney, and lopsided porches or stairs. A damaged roof is a major factor, which can quickly and severely impact the entire home. An appraiser will also inspect the condition of the garage, porch, siding, decking, driveway, and any other exterior elements.

Interior

An appraiser will note if your home is extremely dated, which will limit its appeal to a small number of buyers. An appraiser will record the number of bedrooms and bathrooms and whether there is a basement, attic, or storage space. They will assess the home’s foundation and will note the condition of the floors, windows, and walls. While cosmetic details are not of major importance, they will note whether the home is in poor condition. They will inspect doors, windows, ceilings, walls, leaky plumbing, and obvious electrical issues. Water damage can wreak special havoc on a home, so is a critical factor.

Home Size

Simply put, an appraiser will consider other homes that are similar in size to your home in the same area. A home’s square footage, number of bedrooms, and lot size are the most salient factors when determining your home’s value. The garage size is an important factor since a home with a 3-car garage will appraise higher than a home with a 1-car garage, all else being equal.

Home Improvements

Updated kitchens and bathrooms can have a major impact on appraised value, as will energy-efficient appliances and windows. Upgrades to other elements like flooring, outdoor kitchens, porches, patios, or fencing can boost your home’s appraised value. An appraiser will also note whether your home is heated by gas or electricity; and will note any outdated heating and cooling systems. Be aware that certain home improvements add value to a home, while others do not. For example, the cost of adding a pool will typically exceed the adjusted amount given on an appraisal.

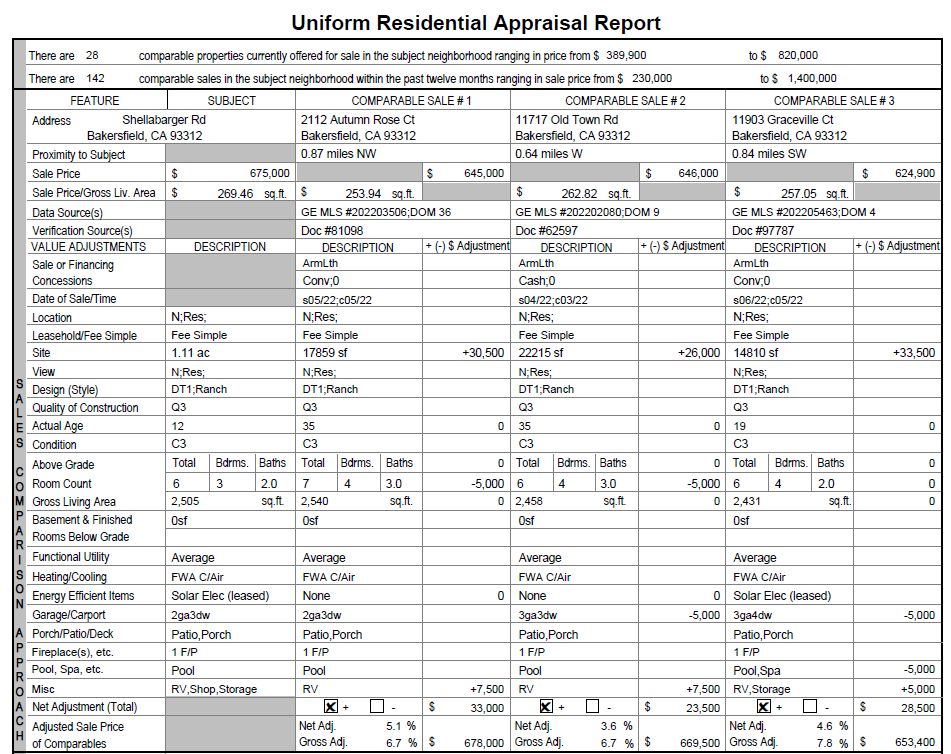

How is the value of a Bakersfield home determined?

A Bakersfield appraiser will use a combination of the above factors and comparable sales in the area to determine the appraised value of a home. They will consider recent sales prices for similar homes in the same neighborhood, taking into account any differences and adjustments to arrive at an estimated market value for the subject property. Appraisers may also look at various economic indicators such as employment rates and the overall housing market in the area to determine value. Ultimately, it is up to the lender to accept or reject an appraiser’s valuation of a home.

Why are some homes worth more than others?

Some homes may be worth more due to location, size, condition, and the level of upgrades and amenities. In addition, demand for certain types of properties in a given area can also drive up prices. For example, a home in a highly desirable neighborhood or school district will likely be worth more than a comparable home in a less sought-after area. Additionally, homes in areas with strong job markets and low crime rates tend to be worth more. Ultimately, the market sets the value of a home, as buyers are willing to pay certain prices based on their perceived value of the property. However, it is important to note that appraisals may not always reflect the actual sale price of a home, as market conditions and individual circumstances can also play a role in determining the final sale price.

How can you increase the value of your home?

Making updates and improvements to your home can increase its value, although it is important to keep in mind what is actually adding value and what may just be a personal preference. Upgrading the kitchen and bathrooms, making energy-efficient upgrades, and improving the curb appeal of your home are all good ways to add value.

In addition, maintaining the overall condition of your home, including regular upkeep and repairs, can also help increase its value. Ultimately, it is important to be aware of market conditions and comparable properties in the area when making improvements to ensure that you are getting a return on your investment.

Working with a real estate professional can provide insights into what updates may add the most value for potential buyers in your area.

It’s important to note that the value of a home can change over time. Factors such as changes in the local market, improvements, property deterioration, and economic conditions can all impact a home’s value. It is important to stay abreast of these factors to ensure that your home maintains its value over time.

One factor that is often overlooked in determining a home’s value is the presence of a garage. An attached or detached garage can add significant value to a property, all else being equal. This adds convenience for the homeowner and provides potential buyers with additional storage space and workspace.

Additionally, having a garage can also provide added security for vehicles and other belongings, potentially making the home more appealing to buyers. When making improvements or updates to your home, it may be worth considering adding a garage if possible.

What happens if the appraised value is lower than the contractual purchase price?

The lender will only be willing to provide a loan for up to the appraised value of the home, which creates a situation where several options may be pursued:

- The appraiser can be asked to reconsider the value based on more information provided by the buyer, seller, or real estate agent.

- The seller or buyer can cancel the transaction, which forces the seller to start over and hope for a higher appraised value and forces the buyer to find a different home.

- The seller can agree to lower the purchase price.

- The buyer can agree to increase the down payment.

- The buyer and seller can meet somewhere in the middle.

It’s important to note that real estate agents are legally prohibited from any communication with home appraisers that is intended to influence the outcome of the appraisal. However, an appraiser can be asked to provide additional detail explaining how they arrived at the ultimate opinion of value.

Who conducts the home appraisal?

A certified and licensed appraiser conducts the home appraisal and is typically hired by the property buyer’s lender. It is important to note that the appraiser should not have any bias or conflict of interest in the transaction, as this can affect the accuracy and credibility of the home appraisal process. They should not have any relationship with the mortgage lender, buyer, or seller. They must be a neutral third party who can provide a fair, unbiased appraisal of a house.

What’s the cost of an appraisal?

The cost of an appraisal can vary based on the location and size of the property, but it is typically a few hundred dollars. The expense is paid by the buyer and is a necessary part of the home buying process. It ensures that the property is correctly valued and that the buyer is not overpaying for the property. It also protects the lender by ensuring that they do not provide a loan amount higher than the value of the property.

In the Bakersfield area, the cost of a home appraisal typically ranges between $400 and $700. The mortgage lender orders the appraisal, but the buyer typically pays for it. If the sale is not completed, the appraisal fee is typically non-refundable unless it’s for an FHA loan and a subsequent FHA borrower buys the home.

For more information, Contact Us or let us connect you with a Bakersfield Realtor.