Contingencies are escape clauses that mitigate the risk for both the buyer and seller of a home when unexpected circumstances arise. They are conditions in the purchase agreement that must be met before the purchase can be finalized.

Common examples include a home inspection, obtaining financing, or the sale of the buyer’s current property. These conditions are essential to the home buying process.

In a contingent offer, the buyer can ask for all possible contingencies, but the seller doesn’t have to agree to them. Both parties must agree on all contingencies before signing the contract.

An experienced Realtor can help a buyer decide which contingencies to include based on their knowledge of the home and the current housing market.

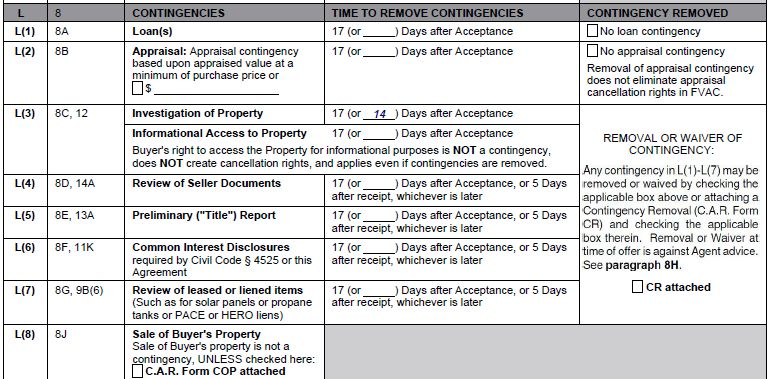

Below is the section of the California Residential Purchase Agreement that details each contingency and the time to remove each contingency.

What Are the Most Common Contingencies?

Inspection Contingency

This contingency protects the buyer by allowing them to walk away from the purchase or negotiate repairs if significant issues are found during a professional inspection of the property.

This is an important protection for buyers, as it allows them to avoid purchasing a home with serious defects. It’s also important to remember that the seller must agree to any inspection contingencies included in the contract.

While the home inspector will evaluate the inside and outside of a property, it is also advisable for buyers to have the home further inspected by specialists for insect damage, septic tanks, roofing, electrical, HVAC, or anything else that is cause for concern. The home buyer typically pays for the home inspection because it protects the buyer’s interests.

Timing

The home inspection contingency period typically expires within 2-3 weeks but sometimes much less. Most sellers want a shorter time frame in case an agreement about repairs cannot be made. Removing this contingency or canceling the transaction as quickly as possible benefits both the buyer and seller. Upon cancellation, the buyer can resume looking for a different home and the seller can resume looking for a different buyer.

If the buyer does not notify the seller of any problems or repair requests within the contingency period, the buyer may not be able to cancel the transaction. In this case, the earnest money might not be returned to the buyer.

Appraisal Contingency

An appraisal contingency is a clause in a home purchase agreement that allows the buyer to back out of the deal if the home’s value comes in lower than the purchase price. This protects the buyer from overpaying for a home or the housing market suddenly tanks after the purchase agreement is signed.

An appraisal contingency and a financing contingency are inextricably linked. Financing will only be approved if the home appraisal is acceptable to the lender.

If a home’s appraised value comes in lower than the contractual sale price, several scenarios are possible:

- The seller might be willing to lower the price to the appraisal amount.

- The buyer may be willing to chip in more cash to make up for any shortfall.

- The buyer and seller may agree to something in between.

- Either party may cancel the contract.

Timing

The home inspection contingency period typically expires in 2-3 weeks. The timing of the appraisal mostly relies on the availability of the appraiser, so the contingency is typically only removed when the appraisal is complete and acceptable. The deadline is usually extended by the seller if necessary.

However, if the homebuyer does not notify the seller of any issues or delays with the appraisal, the buyer may not be able to cancel the transaction. In this case, the earnest money might not be returned to the buyer.

Financing Contingency

This contingency ensures that the buyer can obtain a mortgage for the purchase and protects them from losing their earnest money deposit if they are unable to secure financing. It also protects sellers from having to wait indefinitely for a buyer to secure financing.

A buyer’s ability to secure financing can change based on several factors. A significant change in cash position, employment, income, or credit can have a negative impact and prevent the final loan approval. If a buyer is not approved for the mortgage within the contingency period, the seller should be notified and the transaction canceled.

Timing

The financing contingency period typically expires in 3 weeks, and can be extended with the approval of both parties. The buyer should work closely with their lender and real estate agent to ensure they are on track to meet this deadline. If the buyer’s mortgage approval is denied and the seller is not notified, the buyer will likely lose the entire earnest money deposit.

Title Contingency

Another important contingency is the title report. The title report documents the home’s history of ownership. A title contingency will stipulate that the purchase of the home not go through unless the title report shows that the home is free and clear of any liens.

Most of the time, a lawyer or a title company will review the title on a home before the closing. If there are any issues, these institutions will resolve any discrepancies so that the buyer can have the title transferred to them free and clear.

Another key aspect is title insurance. This compensates the insured buyer or lender if there is a defect on the title, any liens or if there are any competing claims of ownership on a property after the closing. It will protect a buyer in case there is a title dispute on their property by compensating them for any loss and will cover any legal fees related to the dispute.

Timing

The title contingency period typically expires in 2-3 weeks, but it can be extended if both parties agree. The title company is in the driver’s seat and will keep all parties informed about any issues and whether an extension is necessary. Serious title problems will often result in a cancellation until they can be resolved.

Home Sale Contingency

This contingency can apply to the buyer or seller or both. Buyers use it when the purchase of their next home is contingent on their ability to sell their current home. It states that if the buyer sells their home by a specific date, they will purchase the new property and the contract will move forward. If they do not, then the contract is terminated.

Sellers use the sale contingency if they must find a replacement home before selling their current home. A buyer should make sure that the seller is actively looking for a replacement home and set a deadline of 30 to 60 days, but that could be longer depending on the situation.

Sellers are much less likely to accept this contingency than any of the others since valuable time could be wasted by waiting for the buyer’s home to enter escrow or close escrow. However, the seller’s risk could be reduced by continuing to market the home and holding backup offers.

How Often Do Contingent Deals Fall Apart?

Contingencies in real estate contracts are very common and expected. The likelihood of a contract being cancelled after an initial acceptance is relatively low. The most common reasons deals fall apart are repairs that arise from home inspections and loss of income. A loss of employment is rare and can’t be predicted so should not be a concern of a seller. Repairs are a major part of the transaction and must be discovered and dealt with. After all, it’s a house and someone will have to deal with them eventually.

Depending on the real estate market, a buyer might be tempted to forgo some or all contingencies. However, not including contingencies carries significant risks as already explained and should be avoided if possible. An offer without contingencies may help in getting an offer accepted but the buyer should be fully aware of the extra cash that may be necessary to cover an appraisal gap or make unexpected repairs.

Contact us if you need more information or would like advice from a top Bakersfield Realtor.